Content

Over the past few years, the pandemic has brought Rolls-Royce a lot of problems. Things are moving well because the share price is 15% higher now than it was a month ago. There are indications all over that the price of a share could increase. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Whether Rolls-Royce Holdings is a good stock for you to buy depends on your view of the company and your personal investment objectives. Remember, it’s very important to reach your own conclusion of the company’s prospects and likelihood of achieving analysts’ targets.

- It’s doubtful whether we will notice any type of instant progress in this area because RYCEF is heavily exposed to the weakest market sector.

- “We are working across the group to increase the productivity and efficiency of our operations and improve commercial discipline to drive a better and more balanced financial performance,” it stated.

- You can view the full broker recommendation list by unlocking its StockReport.

- Because of the intriguing direction, the company’s growth is taking, analysts are growing more enthusiastic about RR shares.

- Things are moving well because the share price is 15% higher now than it was a month ago.

While access to information in the modern world, connected by the internet, has become easy, it’s overly hard to identify what is true & what is not. Policy Pursuit is an effort to help provide sifted news and updates about the world in general and Pakistan in particular. The overall consensus recommendation for Rolls-Royce Holdings is Buy. You can view the full broker recommendation list by unlocking its StockReport. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

Rolls-Royce currently holds a 58% market share for major aerospace engine projects, and recent contract victories support this. More than £1.3 billion in cost savings have already been achieved, and 7 out of 9 Trent 1000 repairs are presently being carried out. Additionally, the firm leads the industry in large-cabin long-range commercial aviation with an 88% market share. The return to an investment-grade credit ranking is one of the company’s present key objectives, and the road there is open. By meeting its goals, including those of its disposal and restructuring initiatives, the business will try to lessen the uncertainty. The business has already increased its liquidity and now has over £2.6 billion ($3.16 billion) in cash on hand, with an additional £4.5 billion ($5.5 billion) of undrawn liquidity that can be used as required.

Rolls-Royce – Updating on the company

While the airline stocks have been performing well since last month, Rolls Royce share price has failed to experience a similar move. The shares are currently trading 8.7% below their yearly highs and are hanging by a thread after prolonged sideways price action. Their consensus Rolls-Royce share price forecast for 2023 is was for the stock to rise modestly by 1% over the coming year to 104.84p from its 103.76p closing price on 9 January 2023. The highest Rolls-Royce share price forecast came in at 146.74p, while the lowest suggested a fall to 74.87p.

In the meantime, I’ll keep sharing updated https://g-markets.net/helpful-articles/what-is-a-pip-in-forex/s and my personal trades on my Twitter where you are welcome to follow me. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. According to the algorithmic forecasts of WalletInvestor at the time of writing, RR stock was a “bad long-term investment” that was predicted to fall 14% to 89.41p. Any Rolls-Royce share price prediction needs to consider the most recent earnings, with the company having issued half-year results in early August 2022. But there are hopes of a brighter 2023 in the wake of a cost reduction programme and the appointment of a new chief executive. Since October 2022 the RR share price recovered some losses, bouncing back over 50%.

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Reliance Industries Share Price Surges To Fresh Yearly Highs

“Not only will this flight pave the way for future generations, but it will demonstrate just how much we can achieve when we work together on a shared goal,” he said. MarketBeat’s analysts have just released their top five short plays for July 2023. Learn which stocks have the most short interest and how to trade them. Sign-up to receive the latest news and ratings for Rolls-Royce Holdings plc and its competitors with MarketBeat’s FREE daily newsletter.

An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Rolls-Royce Holdings PLC RR.-GB:London Stock Exchange

You can use Stockopedia’s share research software to help you find the the kinds of shares that suit your investment strategy and objectives. The current ABR compares to an ABR of 1.67 a month ago based on six recommendations. The consensus view of 10 analysts compiled by TipRanks as of 10 January was for RR stock to rise 1% over the coming year to 104.84p.

- Rolls-Royce Holdings plc’s stock was trading at $1.07 on January 1st, 2023.

- All of our research, including the estimates, opinions and information contained therein, reflects our judgment as of the publication or other dissemination date of the research and is subject to change without notice.

- Stocks can be purchased through online brokerage accounts that support trading on the London Stock Exchange (LSX).

- The scores are based on the trading styles of Value, Growth, and Momentum.

- While flight prices are anticipated to slightly decrease, demand for wide-body travel is anticipated to stay high.Additionally, Rolls-Royce will be helped by the reliable electricity and defense sectors.

- The market for expensive products has been impacted by the worldwide recession; as a result, Royce’s stock price has dropped.

According to Citi analysts, the shares have had a steady start to the year. The site’s Rolls-Royce share price forecast for 2025 saw the stock tumbling to 73p by January 2025 and to 61p by the end of that year. Rolls-Royce Holdings plc saw a increase in short interest in the month of June. As of June 30th, there was short interest totaling 193,500 shares, an increase of 31.9% from the June 15th total of 146,700 shares. Based on an average daily volume of 5,458,200 shares, the days-to-cover ratio is currently 0.0 days.

Week Data

By focusing on product longevity, quality, and current flight trends, the business hopes to succeed. RYCEF is still experiencing a crisis, but this crisis is now blending with a general upswing from contracts gained and other advantages. I’ve written a few times about Rolls-Royce over the past year and more recently. Despite the fact that there are many things to like about the business, I’ve always ended up with a tepid “HOLD”. The business has been restructuring, rearranging, and doing damage control for the past few years, and this work has continued here.

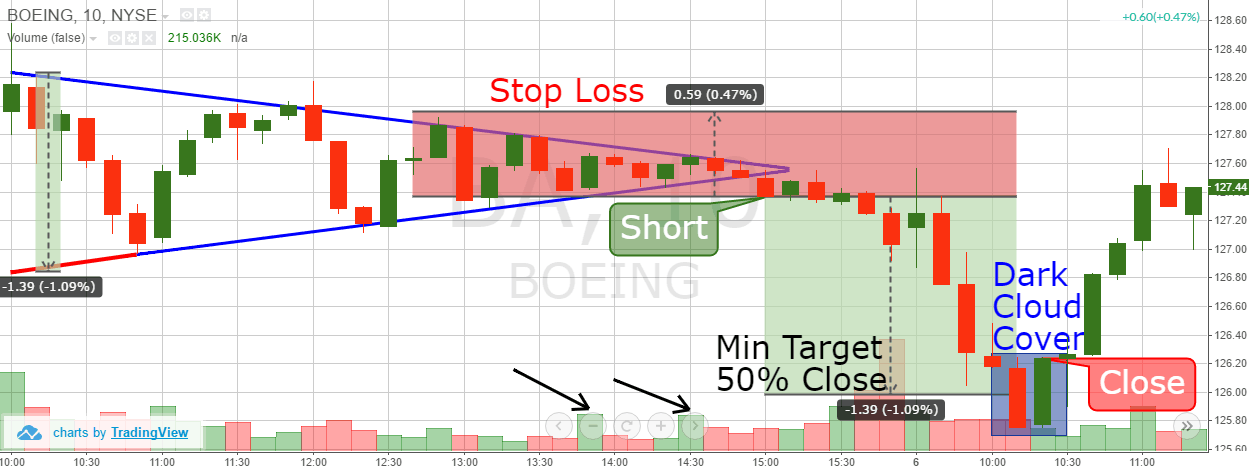

Zacks provides the average brokerage recommendation (ABR) for thousands of stocks for most of the leading investment web sties. The ABR is the calculated average of the actual recommendations (strong buy, hold, sell etc) made by the brokerage firms for a given stock. In the latest Rolls-Royce news, the investment giant JPMorgan has reiterated its sell rating for the shares of the jet-engine manufacturer. As per the details, JPMorgan has set a price target of 90p for the stock. Rolls Royce share price is expected to remain volatile for the rest of the day as markets try to absorb the upcoming rate decision. Nevertheless, we can still analyze its chart on a higher timeframe to remove the noise.

For example, Jefferies recently raised the stock from a ‘hold’ to a ‘buy’ and lifted its price target from 90p to 125p a share. The PE ratio (or price-to-earnings ratio) is the one of the most popular valuation measures used by stock market investors. It is calculated by dividing a company’s price per share by its earnings per share.

An important predictor of whether a stock price will go up is its track record of momentum. Price trends tend to persist, so it’s worth looking at them when it comes to a share like Rolls-Royce Holdings. Over the past six months, its share price has outperformed the FTSE All Share Index by +45.44%. Only one analyst offered a short-term price target of $2.30 for Rolls-Royce Holdings PLC.

PEPE Coin Price Prediction: PEPE To Surge Another 22%?

Upgrade to MarketBeat All Access to add more stocks to your watchlist. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation.

Rolls-Royce Holdings plc’s stock was trading at $1.07 on January 1st, 2023. Since then, RYCEY stock has increased by 79.4% and is now trading at $1.92. It plans to achieve this primarily by reducing expenses and improving outcomes. With an order inventory of over £50 billion, a better underlying EBIT of nearly 500,000 GBP, and some gains already recorded in the books, Rolls-Royce has no lack of orders.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. The share price of Rolls-Royce recently increased after China began to abandon its Covid-zero plan. Since the company’s civil aviation model utilizes the razor-to-razor model, this is a good indication for the business.

Rolls-Royce share price forecast: Can new CEO and cost-reduction programme revive RR stock?

Aerospace giant Rolls-Royce (RR) is focused on the future after battling to recover from the damaging effects of the Covid-19 pandemic. The company, which makes aircraft engines and power solutions, has seen its share price plummet almost 56% over the past three years. Additionally, they counsel investors against making any adjustments at this time, such as purchasing additional shares or selling some.

This represents an increase of 19.79% from the last closing price of $1.92. On Thursday, Rolls Royce share price fell 4.8% in its biggest drop since March 2023. The bearish price action follows the 3.07 rise during its previous trading session. The UK stocks showed a mixed price action on Thursday as the benchmark FTSE 100 index remained sideways. It’s important to draw your own conclusions and not rely solely on Rolls-Royce share price prediction of analysts. Your long-term investment goals and attitude to risk must play a part in the decision-making process.

To increase its worldwide footprint, the business intends to make financial investments in cutting-edge technology. In order to maintain its position at the top of the premium vehicle market, the business, which has a long history of success, seeks to adopt and carry out new ideas. Analysts anticipate strong growth for the civil aircraft sector in 2023. While flight prices are anticipated to slightly decrease, demand for wide-body travel is anticipated to stay high.Additionally, Rolls-Royce will be helped by the reliable electricity and defense sectors. As the economy improves, more orders for the military are anticipated. You’ll want to be able to purchase the stock if and when it becomes a more obvious investment if you decide to keep an eye out for improvements at Rolls-Royce.